All Ears

Financial Literacy students sit in on a live podcast on how to handle money in the real world.

Business teacher Mr. Langue introduces his students to the Troutwood investment team just before the group turned on the cameras and microphones to record a podcast in the library.

It’s a common complaint. A high school education consists of four years of useless dates, names, and equations and nothing about the real necessities of adult life. But business teacher Jordan Langue is looking to change that.

On December 18, Langue’s students reported to the library, which they found transformed into a podcast studio, with cameras in focus and microphones on. Financial experts from Troutwood, a Carnegie Mellon fintech startup, greeted the group and began recording.

“It was a great opportunity for students to reflect on their long-term financial goals and learn from people who know firsthand the importance of investing early,” Langue said.

The podcast, titled “We Believe,” focused on how financial goals “keep focus on where we want to go and how to get there,” a statement given by the lead host Gene Natali. Other guests on the podcast included the co-host Jay Morrison and interns from Penn State, Pitt, CMU, and IUP.

In the spring, Troutwood aims to launch an app that will enable young adults to easily get started in the investing world. Co-founder Natali and Langue were childhood friends, and when the business teacher learned of Natali’s new venture, he was inspired to introduce his students to the startup team.

“For investing, between the ages of 18 and 22 could be the difference of hundred of thousands of dollars, so it’s important to educate young,” Langue said.

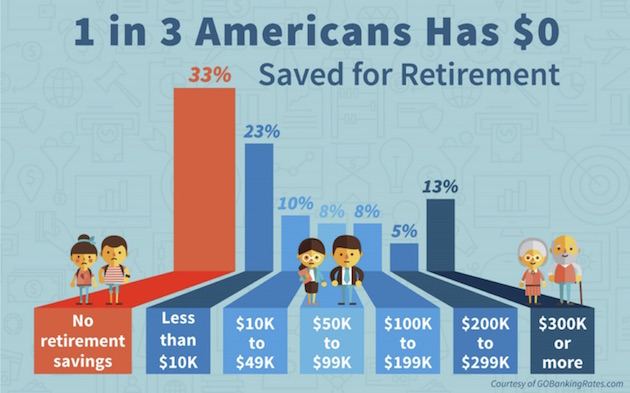

As worker pensions are increasingly rare and the responsibility of saving for retirement is now commonly a matter of employee choice, many national experts have sounded the alarm that a retirement crisis will soon be at hand. According to The Boston College Center for Retirement Research, over half of America’s current workforce will have not have saved enough money to live comfortably in retirement.

Natali and his colleagues were eager to share their message with their student audience.

“Financial empowerment and the peace that comes with it is our ultimate goal,” he told the crowd.

Natali is also the co-author of The Missing Semester, a book about the need to better educate America’s youth in the ways of investing.

“We feel if teenagers start good saving techniques now it can help them be better prepared for the future,” the book states.

Senior Delaney Haller was among the dozens of students who attended the event.

“It really inspired me,” she said. “I learned a lot more than I thought I was going to and I definitely want to look into opening a Roth IRA.”

The Roth IRA, a retirement saving account that grows tax-free, was one of Troutwood’s main podcast topics. The sooner young people begin to fund their Roth IRAs, the Troutwood team told their audience, the larger it will grow in time. In fact, the average yearly return on the S&P 500, a common stock market index of the 500 most valuable companies, is almost 8%, a figure far surpassing the interest rates offered by bank savings accounts.

“[The Roth IRA] will let you go for your dream jobs instead of little jobs that you don’t enjoy,” Natali explained.

Another audience member, senior Mason Conroy, was surprised by the content of the talk.

“It was very interesting,” Conroy said. “I learned more than I thought I would.”

By the end of the podcast, Langue shook hands with his old friend and led his students out of the room with a satisfied smile that perhaps masked a growing national concern.

“A lot of students don’t learn this in high school,” he said. “That’s the real problem.”

Maria Cima is a senior at NASH and on her third year as a staff writer for the school newspaper. As well as writing for the Uproar, she is also a captain for Tiger Thon, a part of Key Club, Actors' Society, fall play, and spring musical. Some of her favorite activities include playing with her dog, singing, and watching American Horror Story. She is very excited to write hard-hitting pieces for the...