First the Cure, Then the Bill

The stimulus package was needed, and we may need more — but let’s not fool ourselves about actual costs.

Fiscally, the nation is careening toward disaster, but options for recovery still remain.

May 7, 2020

Right now, as I begin to write this article, the United States National Debt is $24,864,960,266,299. By the time anyone reads this, that number tens of millions of dollars below what that new number is. When George W. Bush took office in 2001, the national debt was $5.8 trillion. He doubled that figure, Obama added another $8.5 trillion, and everything after the $20 trillion in January 2016 has been added by President Trump.

Trump never planned on reducing the national debt during his first term or possible second term. His administration estimates that the budget would be balanced in 15 years. Now, having passed a $2 trillion stimulus package, with more 12- and 13-figure packages likely to be passed in the future, the thought of a government surplus has faded into oblivion.

As the pandemic continues to savage the labor market, it is of course unconscionable for the government to neglect destitute families. But unless our fiscal policy changes across the board, we are courting long-term disaster.

The government can no longer afford the pace of spending. Significant cuts need to be made to the military, and the age of Social Security must be raised. In addition, taxes must be raised. Tax loopholes must be closed for both individuals and businesses. Revenues must be kept in the United States to prevent tax evasion. Finally, a carbon tax must be implemented.

Even more deadly and invisible than the coronavirus, climate change has the potential to displace 143 million people. Stanford predicts that diseases such as malaria, dengue fever, chikungunya and West Nile virus will become much more prevalent. As strange as it sounds at this time, the world will someday wish COVID-19 was its biggest problem.

The Tax Policy Center, a nonpartisan think tank based in Washington D.C., estimates that a $43 tax per metric ton of carbon would generate $180 billion dollars in revenue per year, increasing to $300 billion over the next ten years as measures become more strict. It is estimated that the average American produces 15 metric tons of carbon per year, although that number is expected to drop to 12 in the next decade.

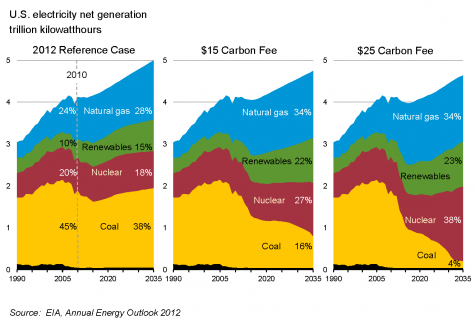

Even a $25 fee per ton of carbon would drastically change the course of U.S. energy production. According to government statistics, in less than 15 years after the implementation of a carbon tax, nuclear and renewable energy would overtake coal as the largest providers for energy. Coal would drop from 38% to just 4%.

Concerns about a carbon tax’s cost to businesses are not borne out in the data. After Germany implemented a similar tax in 2003, it saw positive business effects. Ireland, too, saw success with its program. Implementing a $20 per ton tax in 2010, Ireland decreased its carbon output by 12% in a single year. It is important to note that Ireland’s per capita carbon emissions had been decreasing for years before the tax was implemented, although the rate of decrease accelerated after implementation. Importantly, Ireland implemented its carbon tax during a recession. In the years following its implementation, the country saw GDP growth far above nearly every other EU nation.

As mindful as we are towards to needs of struggling Americans during a public health crisis, we must do more to own up to the real costs of government assistance. While a carbon tax will not completely cover the U.S. deficit, any contribution to filling the hole will help in the future. It is likely that other taxes will need to be added to cover the cost of the stimulus package.

Whatever the solution, action must be taken. In the time it took to write this article, the US debt now stands 24,865,193,500,489.