Dollars and Sense

It’s crucial that schools educate students on personal finance in order to pave their way towards adulthood.

NA’s Personal Finance course teaches students about saving and investing.

May 14, 2021

“When am I ever going to use this in the future?”

As a high school student who has generally been on the honors track all four years, I can confirm that this is a common sentiment among my peers. As we calculate slope or evaluate the difference between sine and cosine, it’s easy to question the purpose—why do we spend so much time in high school learning about things we’ll never use as adults?

For years, I could confidently answer difficult questions brought forth in strenuous math and science classes, but I never cared about what I was learning. With a creativity-preferring personality, I was simply a body in those classes, absorbing information without truly understanding.

So last year, as I went about deciding what classes to take for my senior year, I reflected on what I’ve learned about myself thus far in high school. I was a traditional North Allegheny student, caught up in transcripts and grades and ignoring the actually-helpful courses. I didn’t want to take Calculus because I knew it would be a waste of a credit on me, so instead, I made perhaps one of the wisest decisions a high school student could make: I signed up for Personal Finance.

To be honest, part of me signed up for the course thinking it would be an “easy A,” but I quickly learned that’s not the case. Adulthood is hard, and so is learning about it.

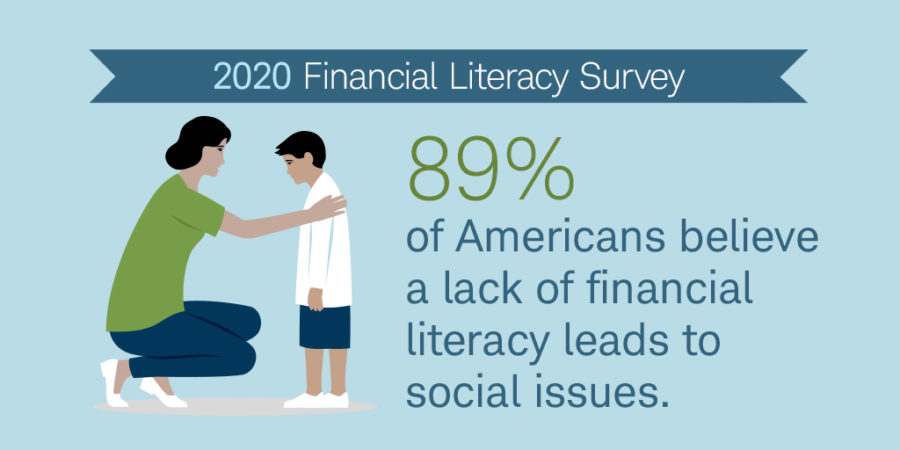

Although technically a math credit, Personal Finance is more about life than anything else. It’s especially sad because there’s a stigma within the school surrounding the course. Almost every adult I’ve ever mentioned the class to says it’s great that I’m taking it, which is understandable given that financial illiteracy is a widespread problem across American culture.

My peers, however, tend to think otherwise.

I have little doubt that their perspective on the Personal Finance course is part and parcel of the elitist culture within NA’s honors and AP tracks. Personal Finance has long been tagged as an “easy A” class, but I have firsthand experience that it is not. I am confident that many of the top students in this school couldn’t explain what a mortgage is or how the stock market works. It’s not necessarily their fault—it’s the school’s culture.

Why take Personal Finance when you could take AP Calculus and get college credit for it? For some students, the answer to this question a no-brainer. But for me, I felt that I was missing out on a real education. Perhaps I was equipped to participate in an episode of Jeopardy (although I’m confident I’d lose), but I never knew how to buy a house.

It’s proof that our education system has big flaws. Every American deserves to be educated in financial literacy in order to prepare for life—real life. And if most high schoolers, especially at NA, aren’t going to opt to take it, then it needs to be a requirement. Disappointingly, only 17 states in the country make it so.

Health Education and S.T.E.M. are both graduation requirements at North Allegheny not because they’re always enjoyable, but because they are essential to creating well-rounded students. It boggles my mind that finance is not.

Within the next few months, many NA students will be making perhaps one of the biggest financial decisions of their lives—higher education and college. How can we expect students to make wise financial decisions when they don’t understand the benefits and consequences of them? The short answer is we can’t—not without proper education.

We would never allow a person without a medical degree to perform surgery. Yet year after year, the American educational system allows students to graduate knowing little about investments, budgeting, types of credit, and taxes. After all, if one of the core purposes of education is preparation for the future, passively enabling financial literacy is an inexcusable betrayal.