NFTs: A Two-Way Mirror

How non-fungible tokens are a reflection of the society that ascribes value to them

Works by Sepand Danesh “Bored Ape Yacht Club” (left) and “The Last Warrior” (right) at the Portrait of an Era NTF exhibition in London

January 10, 2022

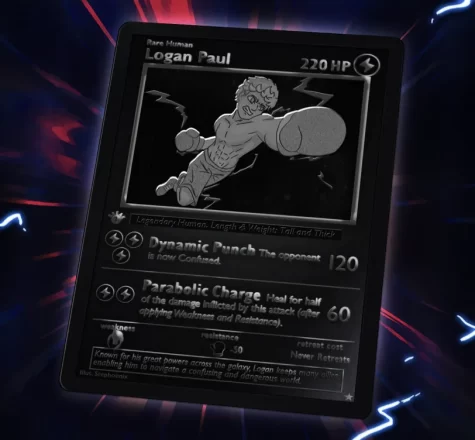

A cartoon aqua Gucci Ghost GIF — $3,600 (but now selling for $16,300). A PNG file of a gray pet rock — $46,300. A “Rare Human” Logan Paul Pokémon trading card (yes, you read that right) — $17,000.

YouTuber Logan Paul sold 5 million dollars worth of NFTs to date, including this Pokémon trading card for $17,000.

While the aforementioned list may sound like the catalog for a ten-year-old’s fever dream auction, in actuality, they are all examples of real NFTs and the prices they were successfully sold at.

The NFT craze has taken over the Internet and investing sphere seemingly overnight, with the industry reaching a whopping $22 billion in 2021.

But while NFTs are now apparently mainstream in the pop culture realm, the public’s understanding of them is less ubiquitous. This year, even Spotify Wrapped referenced the hot button topic and people’s general incomprehension about it.

NFTs are defined as “cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other.” But that doesn’t clear up much.

Let’s start by breaking down NFT in the simplest terms. NFT is an acronym that stands for “non-fungible token.” In economics, “fungibility” refers to how interchangeable a particular good or asset is with other individual goods or assets of the same type. Examples of fungible assets include cash (one dollar bill is as good as another, or four quarters, or 100 pennies, etc.) and cryptocurrencies like Bitcoin. Non-fungible goods, then, are inherently unique at the unit level and are not interchangeable, e.g. baseball cards or acres of land.

Thus, a non-fungible token refers to a unique digital representation of assets, which can be digital or physical. NFTs have been made of everything from art, photos, and videos, to New York Times articles, one of which fetched $560,000, to Tweets. The founder of Twitter sold an autographed NFT of his very first tweet for $2.9 million and donated the proceeds to GiveDirectly’s Africa Response fund. And while less fleshed out than digital assets, there has even been experimentation with tying NFTs to physical objects, such as deeds to a car or a home.

In short, an NFT can be made of nearly anything. Someone could make one of this article.

Most NFTs are a part of the Ethereum (a type of cryptocurrency) blockchain. Think of blockchains as a sort of digital ledger—a written record of all the transactions that occur for public access. Blockchains are more secure than databases because of their differing structure; whereas databases generally organize information into tables, blockchains use—wait for it—a chain of blocks, or groups of information with storage capacities that once filled, are connected to the preceding block and cement that information indelibly.

As cryptocurrencies use blockchain to keep track of transactions, the sale/exchange of NFTs are all recorded on this ledger. Only one person can officially own an NFT at any given time, and it is basically impossible to alter the data confirming ownership.

One important clarification to make is that an owner of an NFT does not own the art, nor the licensing to it. Most NFTs represent digital assets that can be publicly accessed or screenshotted by anyone for free.

What one really pays for when buying an NFT is the code on the blockchain that says that they own it. It’s like paying for the receipt signifying that you own a painting instead of buying the painting itself.

When you buy a piece of art, you get ownership in the form of possessing the physical painting, hanging it up, and displaying it to others. Without this tangibility, a piece of digital art lacks that exclusivity in a way, as an NFT owner does not possess an image compositionally different from one that is screenshotted.

Essentially, buying an NFT is paying for the bragging rights of ownership. This may seem ridiculous, and may very well be, depending on on an individual’s values. But to use the art analogy again: Is owning the original Monet’s Water Lilies the same as owning an exact replica of it? Most people would say no, that the painting’s authenticity and cultural significance add intrinsic value to the piece compared to the forgery, even if optically, they are the same. NFTs carry the same degree of ownership, as odd as it may seem.

Still, there is something mind-boggling about applying this same principle to intangible assets. Much of the mystique wrapped around NFTs likely stems from this disconnect in thinking about conceptual goods as we do material ones.

So why would anyone want to own NFTs? There are actually multiple practical uses for the digital tokens. Like any other speculative asset, buyers can “flip” NFTs that accrue value over time for profit, and make a hefty sum doing so.

Additionally, NFTs can present an opportunity for artists who otherwise may not have been able to market their work successfully. They earn money directly through sales of their own NFTs, but can also potentially earn royalties every time their NFT is resold. As Ethereum’s webpage states, “NFTs power a new creator economy where creators don’t hand ownership of their content over to the platforms they use to publicise it. Ownership is baked into the content itself.”

Potential uses aren’t limited to the online sector either; already NFTs have been used in place of restaurant reservations and ticketing at events. MIT even started offering digital NFT diplomas (sorry, you can’t exchange those).

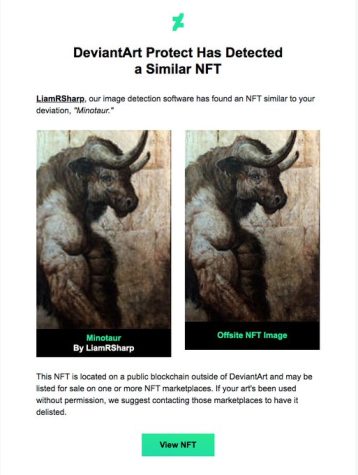

However, woven alongside the abundant fanfare is significant controversy. Despite NFTs potential benefit to small artists, reports have surfaced of artists’ work being stolen and sold as NFTs. One online art platform, DeviantArt, even introduced a new feature notifying artists if an NFT of their work was identified due to the growing issue. Unfortunately, the feature is far from a permanent solution, as one artist, Liam Sharp, ultimately announced that he was closing his gallery on the site because of persistent theft.

Other points of contention include the fact that NFTs, alongside other forms of cryptocurrency, are remain hghly volatile markets, leading to concerns about a future “bubble-burst” of varying degrees of magnitude. The novelty of the industry also means that it is relatively unregulated and plagued by risks of money-laundering.

The most commonly cited grievance with the phenomenon, though, is entirely different: the environment. The process through which the blockchain is secured is called “proof of work,” wherein “miners” undergo a series of complex puzzles to verify transactions. The computer network used to conduct these processes uses an exorbitant amount of energy, with Ethereum’s energy consumption comparable that of the entirety of Libya.

Ethereum contends on its website that this is a result of the decentralized nature of NFTs and that the intentionally tedious process is necessary to ensure security. They also claim that they are switching to a system called “proof of stake” that will reduce Ethereum’s carbon footprint by ~99.95%. There isn’t a set deadline, but the website lists sometime in 2022 as an estimate.

Whether Ethereum will follow through on their promise is a source of doubt for skeptics. Yet, the droves of criticisms directed at NFTs raise the question of why they became successful in the first place. Why did people see worth in random digital images for inane amounts of money (if the following image is any indication, it’s not artistic prowess).

Much like fiat money, the value of NFTs is not inherent but rather due to some external force—in the case of fiat money, it’s government regulation; for NFTs, it’s societal and technological developments.

This concept of how socialization in perceived value of an asset actually impacts how much money a person will pay for that asset explains much of the hype behind NFTs. Imagine a society where baseball or Pokémon have zero cultural significance—their respective collectible trading cards would essentially be relegated to pieces of cardboard in market value.

We’ve seen this manipulation of societal mores in other industries before. Diamonds, while they may have some intrinsic value and rarity, would not be nearly as expensive as they are without the De Beers cartel’s utilization of artificial scarcity and a successful marketing campaign tying romance to the size of a ring in the 1930s.

Ultimately, NFTs are valuable because we say that they are.

If ownership of digital art that exists for the sake of pop-culture clout and resell value rather than artistic excellence is now a viable industry, doesn’t that reflect the impact of technological advancement on what is culturally considered valuable? If NFTs really are bad for the environment and small artists, and are still sold at exorbitant valuations, what does that say about the population that attributed such worth to them?

Perhaps the victories and vices of NFTs are not necessarily inherent to the technology but rather cast a sharp light on the values that permeate the modern world. Maybe NFTs aren’t the source, but the consequence, of more deeply rooted issues in a consumer-driven economy.

Beyond their practical and normative uses, NFTs function like a two-way mirror—simultaneously looking ahead into the future while reflecting back the image of the present. In the midst of differing opinions on NFTs emerges a broader definition of what they represent: a manifestation of human behavior uncomfortably indicative of the direction our society is heading.