Opinion: Is It Enough?

In the face of a debt-filled future, this year’s college applicants may see President Biden’s loan forgiveness as a small gesture — but it’s a long overdue step in the right direction.

montage: swic.edu & ontocollege.com

College student debt in the U.S. is so exorbitant that many future graduates see the President’s loan forgiveness plan as a mere Band-Aid.

677 billion Hershey Bars or 179 million all-inclusive trips to Hawaii—either option costs roughly $1.6 trillion. This price tag sounds impossible, infinitely exorbitant, simply unfathomable. But it is this same figure, $1.6 trillion, that signifies the total student debt in the U.S.

Across the U.S., one out of every two students who pursue an undergraduate degree will graduate college with debt. When you look at your lab partner in AP Bio, they have a fifty percent chance of being in debt, or as you wander the halls between classes and make awkward eye contact with kids you’ve never noticed before, remember that half of them may be forced to take out a loan to pay for college.

As NASH seniors enter the grueling college admissions process this fall, they are forced to ask themselves more than just whether a college will be a good fit. The other critical question before them is whether they can afford it.

By January, many seniors will be well aware of the opportunities for scholarships, grants, and low-interest loans. The possibilities are numerous, from the FAFSA to merit-based scholarships.

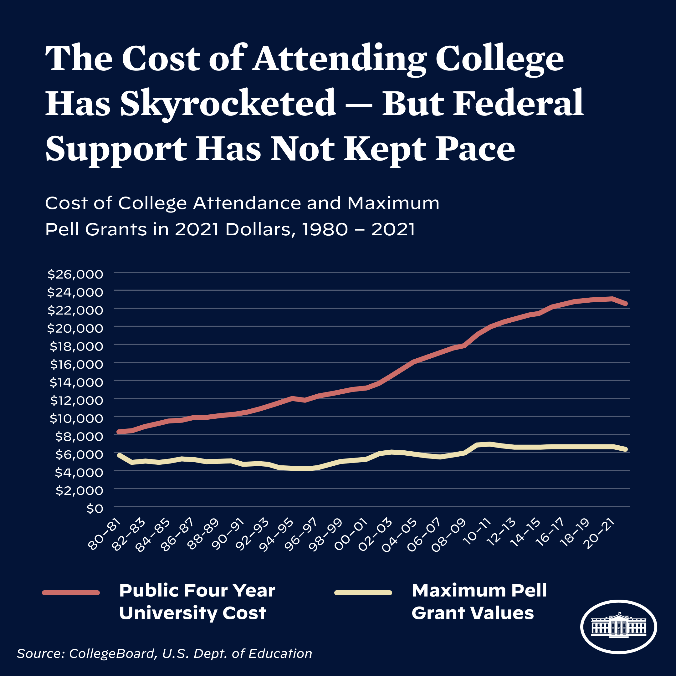

But the price of public and private colleges has tripled since 1980, while scholarships and grants have not kept up. For most low- and middle-income students, there is only one other option remaining—loans.

Near the end of the summer, however, the Biden administration came through on its promise of debt forgiveness. The three-part plan will begin by giving $10,000 in loan forgiveness to graduates who make less than $125,000 a year.

But for middle class students planning on accumulating debt, $10,000 may not make a sizable difference in their financial future.

“I am lucky to have a college fund that will ensure I won’t accrue debt, but for my friends, $10,000 is just not enough,” NASH senior Alison Lee said.

Since I was in middle school, I’ve dreamt of attending NYU —and not just because I want to better relate to “Empire State of Mind.” But watching my mother’s demeanor change when I announced NYU, where tuition, room and board can exceed $75,000 per year, shoved my ego back into place.

From a young age, my classmates and I dreamt of walking across green quads with our backpacks, studying late at night in libraries with papers strewn about the table, and perhaps even moving far from home to an entirely different part of the country or the world. I remember hearing tales from the Class of 2022 about the late nights they spent filling out the Common App or the seemingly endless college tours they went on, but rarely did advice about the financial implications get imparted.

I can still distinctly remember the words of one of my closest friends, a senior last year, as the May 1st decision deadline approached last spring.

“I think I had no choice,” she said. “It was not my top school, but they have given me the most money.”

Hearing these words from one of the most intelligent and motivated people I know broke my heart. I had thought that she was better off than I am financially, but I never knew the stress she was under when choosing between debt and her dream school.

This is the reality that has seniors questioning the bottom line impact of the President’s forgiveness plan.

“As a student from a middle class family, it isn’t making a huge difference,” NASH senior Mia Fleming said. “Families like mine barely get aid as it is, but 10,000 is just a small dent. For me, college debt is just in my future.”

Fleming watched her sister struggle through the same college application process last year. To much of the middle class, $10,000 does too little to offset decades of steep price increases by colleges and universities.

To me, however, $10,000 is a blessing.

As I entered the college application process over the summer, the words of my mother continued to echo in my head: “College debt is the responsibility of a parent.” But we are a low-income family, and I knew that my life and my mother’s will be forever altered by the college I decide to attend.

I’m feeling differently now.

Nearly all recipients of Pell Grants, which can significantly offset tuition fees (though less so in recent years), come from families whose incomes are below $60,000. Biden’s plan, which promises even more money to Pell Grant recipients, will prove to be life-changing to my family.

But problems remain. Though the White House is focusing 90% of debt forgiveness on families like mine, low-income students have only a 10% chance of receiving a college education. In poorer homes and communities, students are less likely to receive adequate motivation and resources regarding a post-secondary education, including its financial implications.

Perhaps the President’s plan will encourage more poor students to continue their education in college. And perhaps it will not make a meaningful difference in the lives of middle class students with the same plans.

But what is for certain is that the nation is moving in the right direction regarding student debt. It is now up to the Class of 2023 to continue to lead the fight.

Sierra O’Neil is a senior at NASH who is graduating in June and this is her first year on The Uproar. She loves to read romance novels while curling up on the sofa with a steamy, pumpkin spice latte. For her nothing beats the thrill of reading an article and it completely changes her outlook on the world. She is excited to be joining The Uproar and being able to put her passions to paper.